Here is the right tool for selecting collections

This method – which important companies have already used to great effect – helps managers select collections with the help of final consumers.

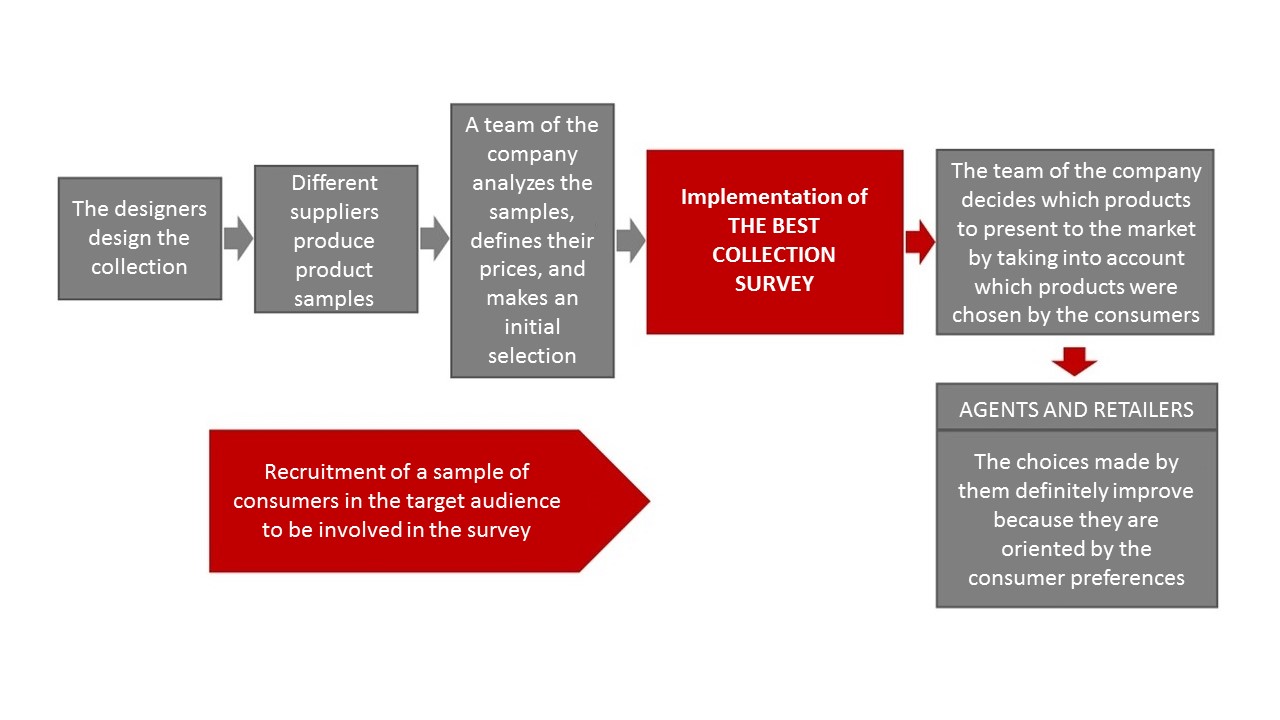

Product samples are labeled appropriately, exhibited in a showroom and shown to a fairly large number of consumers in the target audience (previously recruited). These consumers, after looking at and touching the products, fill out a questionnaire indicating which products they would be most likely to buy.

Only consumers in the target audience are surveyed

Instead of using a panel, people in the target audience are surveyed, i.e. people who purchase products in a specific price range and/or a specific brands list.

Consumers are identified and recruited using a detailed recruitment form. Consumers are recruited during the weeks preceding the arrival of the product samples.

The survey can be performed very quickly

Results can be available within just one week of receiving the product samples.

The survey can be carried out very quickly because everything is organized before the arrival of the products to be tested.

Here is the process that includes the new methodology:

The Best Collection Survey …

… can be applied to any market / country

The survey can be conducted anywhere, thus permitting the identification of any geographic differences in consumer tastes.

… can be applied to any type of product

Clothing, shoes, bags, underwear, nightwear, jewelry and other accessory lines can be tested effectively using this method.

… provides extremely useful information

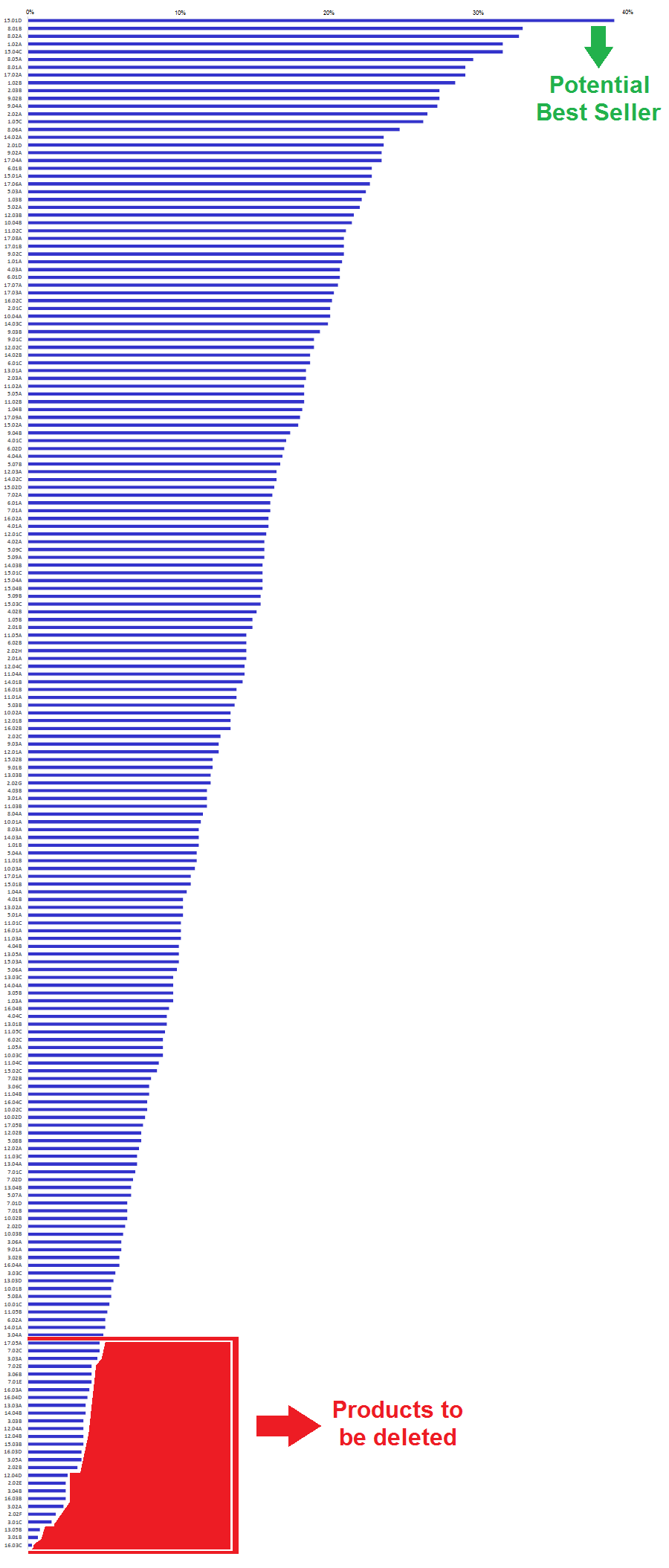

The most important piece of data which this survey delivers is the percentage of consumers who express a positive intention to buy each product.

This information is essential to decide which products should be included or not in the collection. It is also very useful to adjust purchase orders or production volumes, reducing the risk of unsold inventory.

Data are provided by article, market/country and any other parameters of interest, and are presented in both tables and graphs.

… requires a reasonable investment

The required investment is small compared to the advantages it can offer.

The cost of the survey varies based on the number and type of:

– markets/countries which it is performed in

– consumers to be recruited

– products to be tested

An accurate proposal will be provided once these elements have been defined.

Thanks to this reliable and predictive method,

fashion companies increase their sales and profitability because:

| They offer more attractive collections to consumers | They can guide the choices made by their agents and retailers based on consumers tastes | They can adjust their purchase orders or production volumes based on consumers data (reducing the risk of unsold inventory) |

An example of the results provided

The intention to buy reached by each tested product

When the test is conducted internationally the results are processed by country, however, Metron also provides a total ranking obtained by weighting the results with the weighted percentage that each country has in terms of brand sales/turnover.

The data is also analyzed by the age group of the consumers involved and other possible parameters of interest (which must obviously be decided when the criteria of the consumer sample to be involved in the survey is selected).

Having this kind of information is very useful to improve business choices.

Don’t you think?

Fill out the form right away or call (+39 0742 344403) for additional information or to request a more detailed presentation.